Vietnam has lately been steady with its economic performance when it comes to Asian countries operating during the pandemic. Recently the surge in GDP growth of the country has been from becoming the winner in the U.S.-China trade dispute.

As the trade war has stabilized, Vietnam has ramped up its manufacturing game, taking up all the foreign investment while increasing exports across the ocean.

According to the official sources from the majorly trade-reliant country, an estimated $300 billion worth of economic growth is believed to be achieved by the end of the growth target.

Let’s have a look at how Vietnam has become the unprecedented winner of this trade dispute.

How Vietnam Has Become the U.S. China Trade War Winner

Both manufacturing and export are considered economic staples when it comes to a country’s growth. As Vietnam has solidified both over the past year as multinationals shifted gears from China, the Vietnamese timeline can be seen in the following instances.

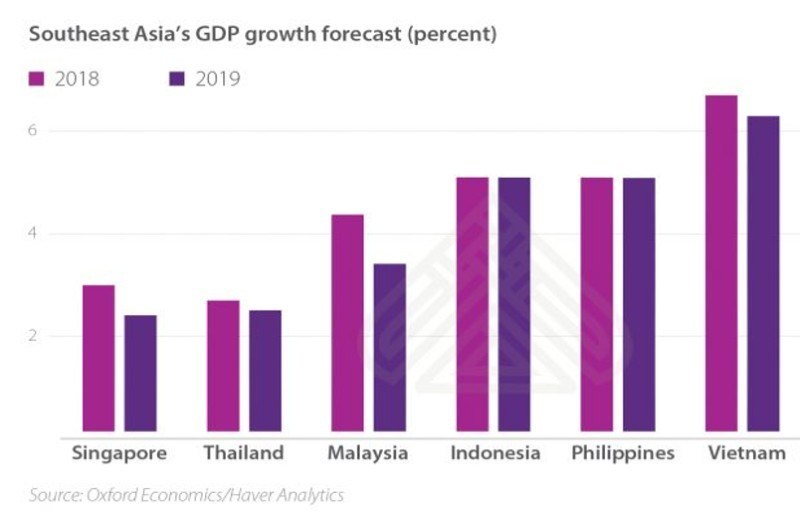

Southeast Asias GDP: Source: Vietnam briefing

1. Vietnam’s economy

Currently, Vietnam has a stable run with its exports and manufacturing, but it has been dependent on solid figures in this regard since the late 80s to rebuild the war-inflicted country it once was.

However, Vietnam’s economy was mainly carried by consumer spending before, so much that it takes a significant 70% of the overall GDP. However, much accounted for its focused dedication; Vietnam today stands as the third-largest popular country among the ASEAN countries.

With the expansion of its upper and middle-income earners, the country expects further growth as manufacturing has risen by 12.3%. The U.S. has been Vietnam’s biggest export market along with the E.U. and China.

2. Advantages for Vietnam in the trade war

Many multinational companies felt ridiculed by the U.S. tariff offerings on goods shipped from China. So the natural move was to shift to Vietnam where they could produce and ship the same good without paying that much of the U.S. tariff.

According to the survey conducted by the American Chamber of Commerce in Guangzhou, the Chinese companies could clearly be seen losing share to companies in other Asian countries, particularly in Vietnam.

Additionally, the country somehow managed to steer clear out of President Trump’s crossfire. Apparently, the good feelings are credited to the February summit that Vietnam hosted for the U.S. and the North Korean leader.

3. Challenges that foreign investors are facing

Even though many companies have shifted operations to Vietnam, there is no doubt that new investors are still finding it difficult. The reason is that despite Vietnam is doing great for itself. They cannot match the same level of manufacturing infrastructure that is of China. From the quality issues of sourcing material to the supply chain networks being slow, Vietnam still has some working to do to keep its investors hooked.

The investors are struggling to comprehend that Vietnam’s supply chain is somewhere what China had a few years ago. Until they catch up, the investors have to work their way around.

4. Reforms being deployed by Vietnam

As discussed above, to keep up with the numbers and investors occupied, Vietnam will continuously require investing in hi-tech manufacturing and expandable infrastructure. They have to source SME development to sync the global supply chains.

On the other hand, the government is looking to stop investing in state-owned enterprises that increase corruption levels with no accountability. Therefore, Vietnam is well in taking up high corporate governance standards to meet international levels of trading. While the market looks good for investors taking up business dealings with E.U., Vietnam is working to stabilize the relationship bridge.

5. Growing Trade Industries

Various companies that deal with a wide range of product categories majorly acquired by the U.S. import market have moved production operations to Vietnam.

From significant purchases made from Boeing Co. and General Electric to the China-based wireless earphone maker GoerTek that works with Apple AirPods and Google’s Pixel smartphone moving its production to Vietnam, the country is well on the edge of riding this wave of economic surge successfully.

The following is the list of growing manufacturing industries of trade goods.

List of Trade Goods

- Merchandize

- Technical Gear and Equipment

- Furniture

- Refrigerators

- Car tires

- Sportswear

- Solar Panels

6. Future Predictions

The whole world is aware that the two economic giants are currently having shaky relations. As it is expected to continue for a while, companies have found it to be a better way of dealing with it by moving operations elsewhere from China.

However, it is vital to note here that rather than entirely abandoning the Chinese market, investors are opting to work with low-cost input sources from Vietnamese markets in addition to Chinese operations.

The uncertainty of the ongoing trade war has led to decisions where the function majorly in Vietnam and still maintain a market space in China.

Bottom Line

All in all, as per the figures, the Vietnamese economy is racking up real profit win in the U.S.-China trade war. Now they just need to ensure that such significant gains are put to good use and not let them slip away.

By Samantha Kaylee

Samantha Kaylee is currently working as an Assistant Editor at Crowd Writer, a platform sought by students for their assignment writing service. Her personal interest in global trade has kept her on edge for researching the changing trends. She shares her expertise and opinions in this regard through her blogs.

Samantha Kaylee is currently working as an Assistant Editor at Crowd Writer, a platform sought by students for their assignment writing service. Her personal interest in global trade has kept her on edge for researching the changing trends. She shares her expertise and opinions in this regard through her blogs.